The Rule Of 40 Formula Is Growth

Posted : admin On 12.01.2020The famous investor and also founder of, — recently wrote a titled “The Rule of 40% for a Healthy SaaS Business”. A couple of days later, an also famous venture capitalist at also wrote a post about it, titled “The Data Behind The Rule of 40%”.These are both awesome blog posts, and this one you’re reading now is a compilation of pretty much everything you need to know about the much-discussed topic.The rule of 40%The rule of 40% is nothing more than a rule of thumb to analyze the health of a software/SaaS business. It takes into consideration two of the most important metrics for a subscription company: growth and profit. GP Ratio = Growth rate + ProfitWhich means that your growth rate plus your profit should add up to 40%.

So in a simple example if you’re growing at 20% you should be generating a profit of 20%. If you’re growing at 40% you could be generating a profit os 0%. If you’re growing at 50% you could even lose 10%.So if you’re doing 40% you can consider you have a healthy business — If you’re doing more than that, well, that’s awesome. Growth RateYou can measure growth in different ways but the easiest one probably just does YoY (year-over-year) on growth. You can always compare total revenue but it’s important to consider monthly revenue, especially if you have one time services in the mix. ProfitYou can also measure profit in a SaaS business — or any business at all — in many different ways.

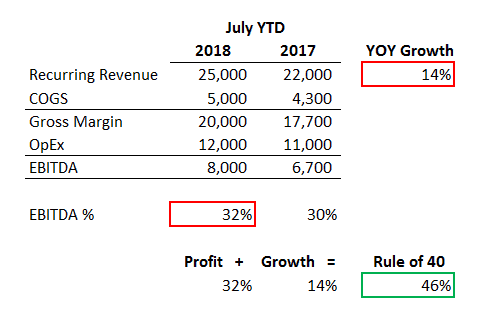

For SaaS businesses, I’ve found the to be a management tool. The basic idea is that as a SaaS business, you want your growth percentage plus your EBITDA percentage to be 40 (or better). So if you’re growing at 50% per year, you can “invest” in growth by having a 10% burn (expense as compared to revenue).

If you’re breakeven at 40% growth, that’s also great. But if you’re only growing 30% you’ll need at least a positive 10% margin to stay healthy.I’ve found myself explaining this concept to lots of founders lately, so if you need a simple walkthrough of what the rule of 40 is all about, I hope this 8 minute video with examples is helpful.There’s also a good argument that the “rule of 40” doesn’t really matter much until the SaaS business is at $15M-$20M+ in revenue run rate.

Basically most successful SaaS businesses often post huge figures for rule of 40 ratios when they’re small mostly because they’re growing so fast and they usually burn money (within reason) in doing so. I think it’s a good habit to get into measuring the rule of 40 early on anyway. In fact, here’s a view only version of the, in case you want to copy it for your own purposes. Please feel free to do so.One concept I don’t really cover in the video (but should have) is the idea that you can use 40 as a “target” that’s ok to exceed.

The Rule Of 40 Formula Is Growth Chart

It’s useful to help you think about investing in growth vs generating more profitability. If you’re profitable with a 10% margin, but only growing at 25%, your rule of 40 calculation would yield 35. So the question to ask would be “Can I re-invest my profitability of 10% to create at least 15% more growth?” By doing so, you’d end up at 0% margin but at least 40% growth This would place your rule of 40 calculation at 40 or better, which is more healthy than the original 35. This helps you think about growth vs profitability in the SaaS context, and in this case it is probably wise to reinvest over profitability with a SaaS business with lots of headroom.I’d love your feedback in the comments and maybe I’ll use it to make a better walkthrough if needed. This was my first shot at a video walkthrough, so let me know in the comments if it’s helpful and how it could be better.

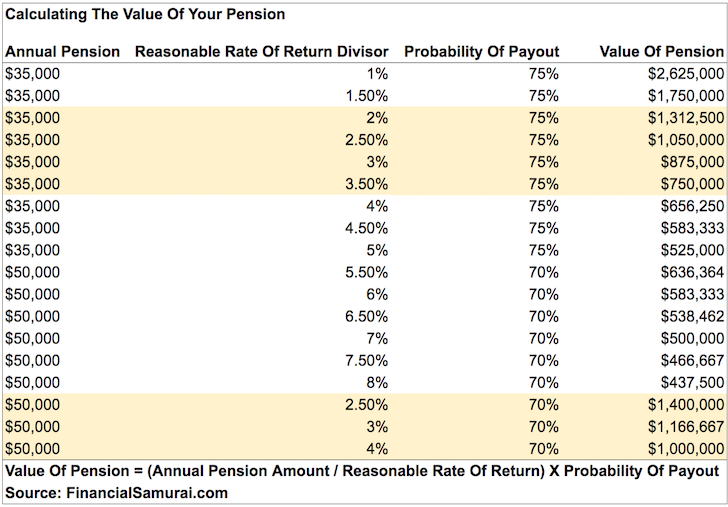

First, this is great. My initial reaction was, “I’ve ready Brad’s blogs, I know this. This seems too simple to need a spreadsheet.” But, after watching the video, there’s more detail than I expected and the valuation component is new and useful.Second, the formula in Row 10 is different (and more company-friendly) than what I had been using. I’ve been calculating the “Margin as a% of Revenue” as (TTM margin) / (TTM.revenue.). But, you’re actually calculating it as (TTM margin) / (Current.ARR Run Rate.). That’s makes sense, but, was a new learning.

The Rule Of 40 Formula Is Growth Formula

Thanks for sharing this.